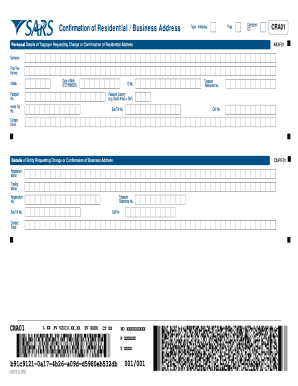

ZA SARS EMP101e 2010 free printable template

Get, Create, Make and Sign ZA SARS EMP101e

How to edit ZA SARS EMP101e online

ZA SARS EMP101e Form Versions

How to fill out ZA SARS EMP101e

How to fill out ZA SARS EMP101e

Who needs ZA SARS EMP101e?

Instructions and Help about ZA SARS EMP101e

Their country's National Defense Force has denied media reports that it is in the process of returning thousands of troops report suggests that Sunday if Move has come after Treasury instructed that the Defense Force should cut its budget by a bar 3 billion rand over the next three years a weekend newspaper says up to 16,000 personnel who include administrative staff and fighting troops will be losing their jobs soldiers on peacekeeping missions and at embassies outside South Africa would also be affected however sandy F has denied all such reports I would like to state categorically upfront that there are no plans let alone a decision to exit member of the defense force due to the recommendation by National Treasury that we should reduce they're our wage bill I also want to confirm with you that the ad discussions both internally and externally to find a solution in order to ensure that no one is exited in the defense force we are also engaging our external stakeholders and national treasure in particular to find a solution to this issue I can say therefore without fear of contradicting myself that there is no such in the Department of Defense and I want to fears from our members that they will be not existing of their membership and what do you think could be the basis of the report well I don't know that question should be asked to the other people that wrote the article

People Also Ask about

How do I register an employee for income tax in South Africa?

What do I need to register my business in South Africa?

How do I register a company for PAYE in South Africa?

How do I register an employee in South Africa?

How do I pay my EMP201?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ZA SARS EMP101e without leaving Google Drive?

How can I get ZA SARS EMP101e?

Can I create an eSignature for the ZA SARS EMP101e in Gmail?

What is ZA SARS EMP101e?

Who is required to file ZA SARS EMP101e?

How to fill out ZA SARS EMP101e?

What is the purpose of ZA SARS EMP101e?

What information must be reported on ZA SARS EMP101e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.