ZA SARS EMP101e 2010 free printable template

Show details

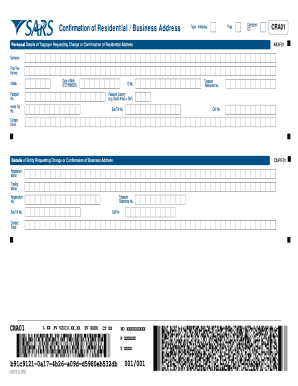

EMP101e PAYROLL TAXES 2010/06/30 SP V3.010 Application for registration www.sars.gov.za EMP101e FOR OFFICE USE Office date stamp SDL Reference number 7 L IF Reference number UP AYE Reference number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA SARS EMP101e

Edit your ZA SARS EMP101e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA SARS EMP101e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ZA SARS EMP101e online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ZA SARS EMP101e. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA SARS EMP101e Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA SARS EMP101e

How to fill out ZA SARS EMP101e

01

Begin by downloading the ZA SARS EMP101e form from the official SARS website.

02

Fill in your business details including the name, registration number, and contact information.

03

Enter the total number of employees and the total remuneration paid to them during the relevant period.

04

List any deductions for employees that apply, such as UIF or other applicable taxes.

05

Ensure all calculations are accurate as per the payroll records.

06

Review the completed form for completeness and accuracy.

07

Submit the form online through the SARS eFiling platform or physically at a SARS office by the due date.

Who needs ZA SARS EMP101e?

01

Employers who have employees and need to report employee remuneration and deductions to the South African Revenue Service (SARS).

02

Businesses registered for Pay-As-You-Earn (PAYE) and wanting to comply with tax regulations.

03

Companies, partnerships, and sole traders in South Africa with a payroll obligation.

Fill

form

: Try Risk Free

People Also Ask about

How do I register an employee for income tax in South Africa?

Register through your Employer via SARS eFiling: SARS eFiling offers the SARS registration function which allows employers to submit employee income tax registrations to SARS. For more information, see the Guide on Tax Reference Number (TRN) Enquiry Services on eFiling.

What do I need to register my business in South Africa?

Notice of Incorporation Type of company. Incorporation date. Financial year-end. Registered address (where your head office is based) Number of directors. Company name. Whether the company name serves as the registration number. The reserved name and reservation number.

How do I register a company for PAYE in South Africa?

Steps: Logon to eFiling. Navigate to SARS Registered Details functionality: Select SARS Registered Details. The Maintain SARS Registered Details screen will display. Select the Payrolls taxes menu item under My tax products > Revenue on the left menu. Select Add new product registration to register new or additional PAYE:

How do I register an employee in South Africa?

If you want to take this approach, employers need to phone the UIF at (012) 337 1680 and follow the instructions of the UIF official. It's important to have all employer and employee details (like ID numbers and addresses) available when starting this call.

How do I pay my EMP201?

Thereafter the employer can make payment at a later time on eFiling; or • Employers will be able to complete the EMP201 and submit to SARS. Payment can then be made via internet banking, the employer's bank or at a SARS branch office. Many employers use the eFiling service to complete and submit their EMP201 to SARS.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ZA SARS EMP101e without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ZA SARS EMP101e, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get ZA SARS EMP101e?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ZA SARS EMP101e and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the ZA SARS EMP101e in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ZA SARS EMP101e right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is ZA SARS EMP101e?

ZA SARS EMP101e is a tax return form used in South Africa for reporting employee-related information to the South African Revenue Service (SARS).

Who is required to file ZA SARS EMP101e?

Employers in South Africa who have employees are required to file ZA SARS EMP101e as part of their payroll reporting obligations.

How to fill out ZA SARS EMP101e?

To fill out ZA SARS EMP101e, employers must provide details about their employees, including personal identification information, total remuneration, deductions, and any other relevant payroll information.

What is the purpose of ZA SARS EMP101e?

The purpose of ZA SARS EMP101e is to report employee remuneration and deductions to SARS, ensuring compliance with tax laws and facilitating accurate tax assessments.

What information must be reported on ZA SARS EMP101e?

The information that must be reported on ZA SARS EMP101e includes employee names, ID numbers, income details, deductions, and the employer's details.

Fill out your ZA SARS EMP101e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA SARS emp101e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.